Auto insurers dealing with the “pandemic price”

Across seemingly every news outlet, it’s hard to escape reports of inflation and rising consumer prices.

And, like other goods and services across the economy, auto insurance rates are a part of the conversation. Currently, many carriers are raising prices to account for unexpected costs—but what’s driving those decisions?

You guessed it. It’s primarily pandemic related, but perhaps not in the ways you might think. As you have conversations with your clients about rising auto insurance costs, the following may help you better explain what’s driving rates to help them better understand the situation.

A return to “normal”

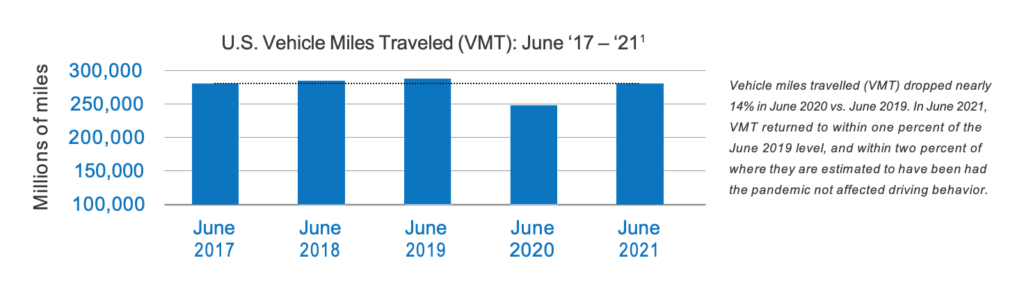

Of course, we’re hardly back to “normal” as the world continues to wrestle with the pandemic, but driving behavior, particularly vehicle miles traveled, has essentially “normalized” and returned to pre-pandemic levels.

At the outset of the pandemic, miles driven dropped, claims fell, and insurers issued refunds/credits, lowered rates, or both. As 2021 unfolded, driving behavior picked up as did claims frequency and, in turn, insurers’ costs.1 Most auto insurers subsequently found themselves underpriced.

Rising repair and replacement costs

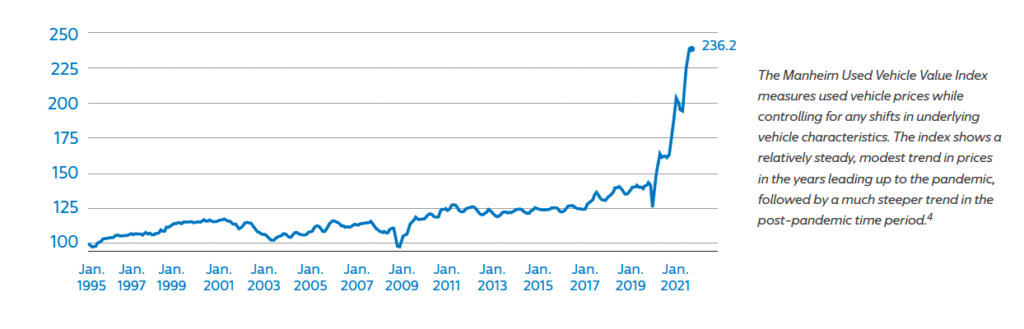

For insurers the past predicts the future. Generally speaking, insurers review historical data and trends to set prices for future expected costs. The pandemic, however, upended expected repair and replacement costs in ways that were challenging to anticipate. Case in point: unpredictable pandemic-related supply chain disruptions and labor shortages have driven claims costs up substantially.2

In fact, the Bureau of Labor Statistics reports that average expenditures for vehicle repairs have risen more than 4% over the last year, while used car and truck prices have skyrocketed by more than 40% over the same period.3

When you combine the uptick in vehicle miles driven and the related increase in claims with rising costs to cover those claims, carriers are paying a “pandemic price” that will affect rates throughout the auto insurance industry in the near term.

How agents can help

Knowledge is power, and while rate increases can be difficult for consumers to accept, as their trusted, expert adviser, you can provide valuable information and context to help your clients understand what’s driving these rate changes.

Consumers choose independent agents for their knowledge and guidance, and in challenging times like these, agents can help clear up confusion, provide expert counsel, and deliver the peace of mind consumers crave in uncertain times.

- U.S. Federal Highway Administration, Vehicle Miles Traveled, Monthly Report: June 2021.

- Insurance Information Institute, “Auto Insurance Rates Impacted By Labor Crunch, Supply Chain Disruptions,” June 2021.

- U.S. Bureau of Labor Statistics, Consumer Price Index, Table 2: July 2021.

- Manheim, Used Vehicle Value Index: June 2021.

Article written by: Keith J. Mita, CIC CPCU AIC – Progressive Insurance Sr. Sales Representative – Personal Lines